contradições do capitalismo

Não estamos no hábito de nos entusiasmar com operações bolsistas mas hey! a acontecer agora num monitor próximo de vcs!, history on tha makin'.

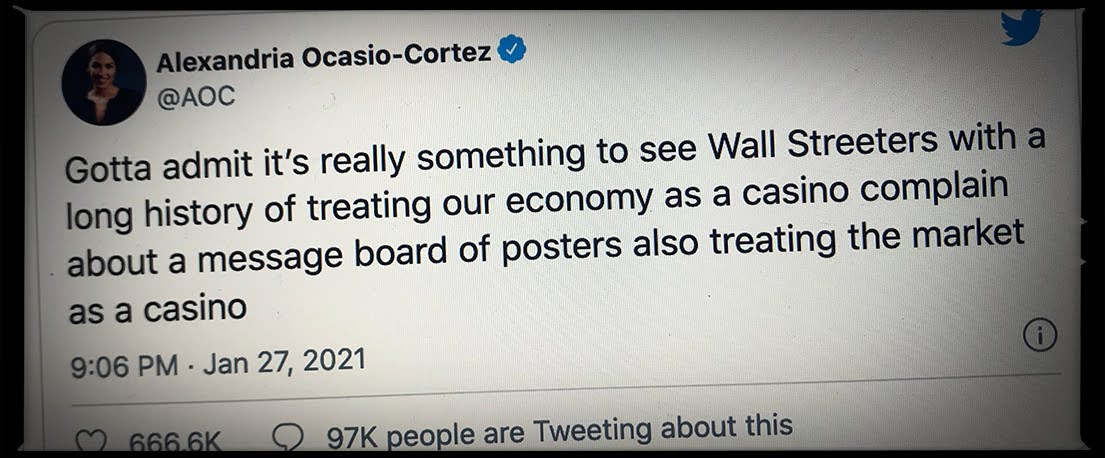

Reuter's reports that "regulators may scrutinize GameStop's Reddit-driven retail stock surge." In other words, the wrong people made money.

in "Regulators concerned that the Reddit day trader army made money in GameStop trading instead of the hedge fund elite" 27 jan 2021

It’s a story that encapsulates quite a lot about life in 2021: the democratization of financial markets, the mobilization of a giant online community, and the ability of obsessed amateurs to alter reality when they put their minds to it, especially when there isn’t much else to do.

in "What the Hell Is Going On With GameStop’s Stock?" 26 jan 2021

Ficámos dos estabelecidos vs trolls arrivistas, seguimos da diferença da teoria e prática do capital com caso prático em contradições do capitalismo no fuckfest bolsista em torno da GameSpot. Perdoados se não seguem a saga, compreensível aka $$$, mas merece os 5 minutos agora: serão 240 minutos mais tarde quando fizerem o filme, e será uma comédia monumental. O resumo possível com algumas leituras a contexto, títulos e highlights:

- "What is GameStop, where do the memes come in, and who is winning or losing?" 28 jan 2021: "How we got here is a complex tale – involving class warfare, the mechanics of meme culture and a phenomenon known as a 'short squeeze'".

- "Anarchy, in-jokes and trolling: the GameStop fiasco is 4chan-think in action" 28 jan 2021: "It has been utterly strange to witness a brief and regretful adolescent occupation re-emerge as a prominent cultural force, to see the notions cultivated on 4chan, the transgressive attitudes my teen brain found so luridly fascinating, becoming general. I will admit, that when I see Wall Street suffering for it, the old satisfaction returns.

- "How GameStop found itself at the center of a groundbreaking battle between Wall Street and small investors" 27 jan 2021: "The battle has become a war of attrition between a new generation of investors and established, more diversified players. Someone’s got to be wrong, but that’s what makes a market. I think it will be an education for some and a good story for everyone else."

GameStop 1984-...?, vende jogos e equipamento de jogos, em lojas físicas. Vira século, os jogos podem ser descarregados de lojas virtuais e os equipamentos comprados online são entregues em casa. Obviamente o seu modelo de negócio aproxima-se do game over. Yet, as acções estão a subir a valores irreais quando deviam descer porque uma enorme comunidade de reddits (r/WallStreetBets, "whose tagline is 'Like 4chan found a Bloomberg Terminal,' has over 2 million members" 26 jan 2021) resolveu fazer um gigante middle finger a grandes fundos de investimento com grande prejuízo para esses. Segue-se descrição dum classic short squeeze:

Institutional investors took out massive short positions against the stock, (...) borrowing the stock, selling it high, buying it back low, and pocketing the difference, minus the fees to borrow the stock. One group that noticed the shorts on the stock was r/WallStreetBets. In September, an enterprising subredditor had posted a seven-point treatise titled “Bankrupting Institutional Investors for Dummies, ft GameStop.” The subredditor noted the stock already had a significant short exposure and predicted that short sellers would be forced to abandon their positions and, in buying back their stocks, drive the price up. They’ve bought the hell out of GME, and short sellers have begun to abandon their positions en masse, leading the stock to go up even more as they buy it back.

in "What the Hell Is Going On With GameStop’s Stock?" 26 jan 2021

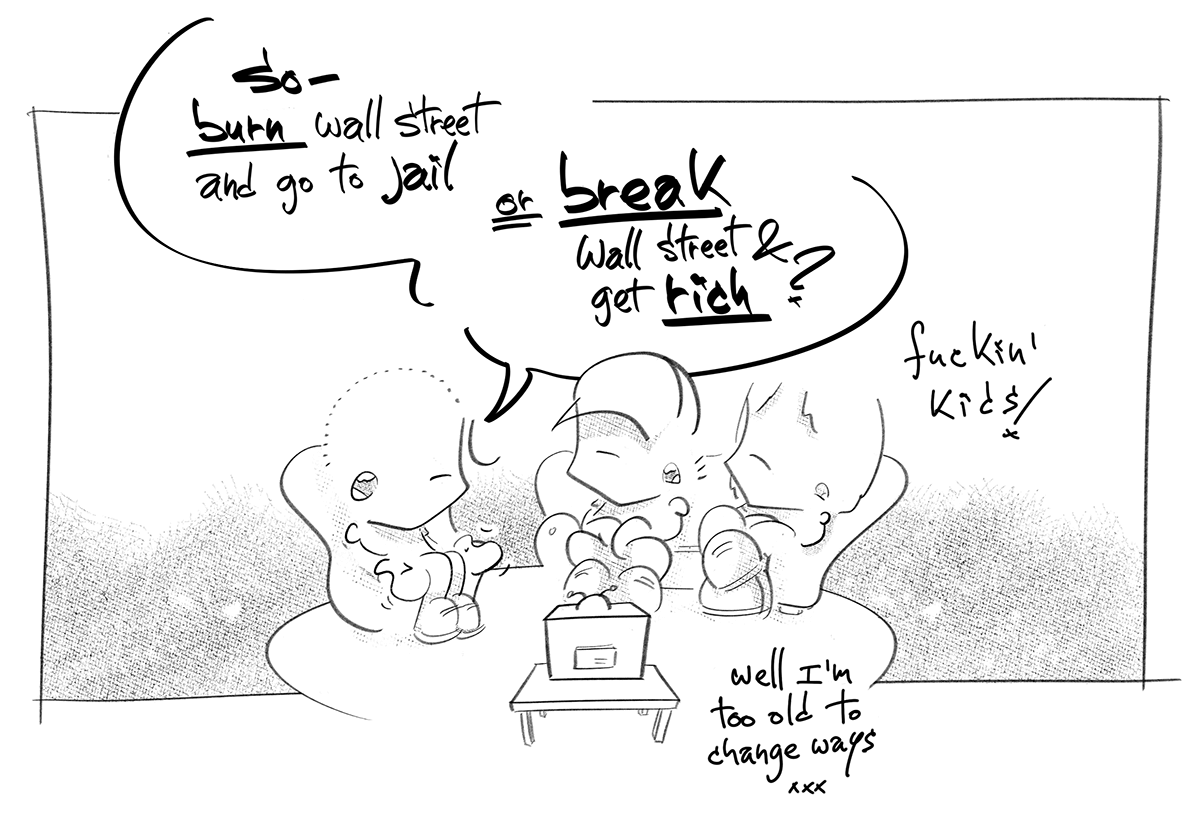

O nosso interesse educativo: i) especialistas vs populares, embate entre "sophisticated investors, cast against the determined amateurs populating internet forums", o diluir de fronteiras entre "internet dorks hyping a stock and some hedge fund magnate going on CNBC to explain why the market will do as he’s predicted" e ii) aquilo da tech: não nos escapa à ironia que tudo acontece sobre um modelo de negócio tornado obsoleto. Saltando os que estão nesta dança pelo guito — good for them —, para onde estamos a olhar:

What the rebels of r/WallStreetBets are doing old-fashioned internet organizing of the guerrilla kind you might find in politics today. "I don’t feel bad at all taking money from these rich greedy hedge fund managers. I’m an old millennial. I’m tired of getting screwed by the globalist elites. This isn’t left or right republican or Democrat. It’s the 1% versus everyone else."

in "What the Hell Is Going On With GameStop’s Stock?" 26 jan 2021

Spoiler alert: ninguém sabe ainda como tudo vai acabar, mas o nosso money está num grande crash quando a bolha explodir. Como alguém disse, não queres ser o último a segurar essas ações —

Everyone wants to be invited to the party but no one wants to be the one left without a chair when the music stops playing… the friction that exists between those two things is what creates volatility.

in "An 'Angry Mob' On Reddit Is Pushing Up GameStop's Stock Price And Pissing Off A Bunch Of Wall Street Firms" 26 jan 2021

...mas enquando a música dura, resultados prejuízos crescem.

The army of traders have declared war on the Wall Street (...) and it has proved to cost them billions.

in "White House ‘monitoring’ GameStop share surge as US hedge fund pulls out" 28 jan 2021

Omg. There’s a WallStreetBets/sea shanty mash-up. And it it is *glorious*. pic.twitter.com/wwRF40KgRK

— Robin Wigglesworth (@RobinWigg) January 28, 2021